Bitcoin Is For Payments

Bitcoin Is For Payments

I know bitcoin payments is not the most popular subject. Most people who tell me they are into "Crypto" or "BTC" only care about one thing. I don't need to say it. You know what it is, but I'll say it anyway: Number Go Down Technolgy, NGD.

-

At the Genesis Block bitcoin began as a timestamp tied to a newspaper headline, "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks." Bitcoin is time. This is how you tell time using the Bitcoin Timechain.

-

A new block is mined every ten minutes on average.

-

We expect 6 blocks per hour.

-

We expect 144 blocks per day.

-

We expect 52,596 blocks every year.

-

We expect 210,384 every 4 years.

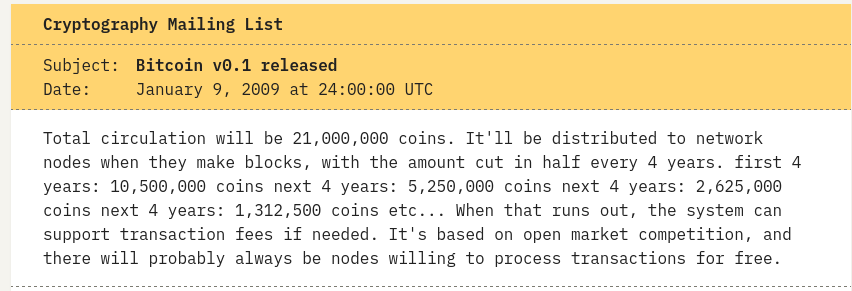

The block subsidy will be cut in half every 210,000 blocks. It's not exactly 4 years, but it's pretty damn close.

-

First, there were 50 new bitcoins rewarded about every ten minutes.

-

Then it was 25 new bitcoins rewarded about every ten minutes.

-

Then...You get the idea.

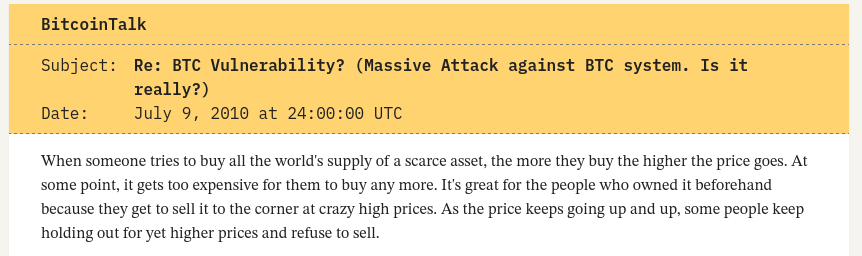

Many people do not want to spend bitcoin. I suspect they are not looking at the diminishing rewards on bitcoin mining. Instead, they are measuring the Bitcoin Timechain through this lens. Don't get me wrong, I need to buy groceries and it's nice to ride an expensive ass bicycle, but fiat is boring.

Don't get me wrong, you should save bitcoin, but you should spend some too. You can use Strike if you want to hold on to "my precious." Transfer fiat to your Strike fiat account and spend fiat if you prefer, but it's better for every bitcoiner if someone on the other side of that transaction stacks more sats. This was difficult, just a hundred thousand blocks ago, but it has never been easier.

Decentralized Bitcoin Payment Options

There are many ways to accept bitcoin for payments. Here is a list, which is by no means comprehensive:

-

HiveTalk -- This is a Nostr-based Zoom Alternative.

-

Block, a.k.a. Cash App and Square - Block is rolling out bitcoin payment options for all Square customers by the end of 2026.

-

Speed Wallet (This is what Steak N Shake Uses)

Each one of these wallets has its advantages and disadvantages. Some are self-hosted, some private, some are custodial, owned by corporations...Among other considerations. An executive order 6102 style attack is possible, but beyond the scope of this article. We assume that any of these solutions give you the opportunity to take self-custody if it makes sense to do so.

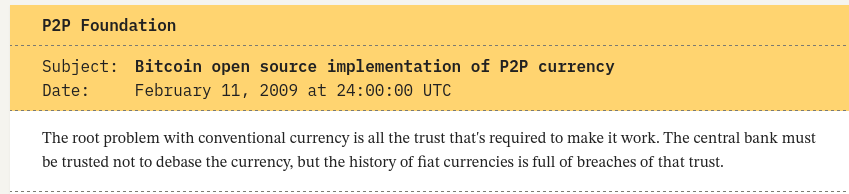

You might ask, "doesn't it always make sense to take self custody?" It's a good question, but it has some nuance. The entire point of bitcoin is to minimize trust as much as possible. Of course you wouldn't trust your life's savings to a custodian. What if you only had 500 sats on a custodial lightning wallet though?

I'd hate to break it to you, but this is below the dust limit. If you only have 500 sats, and the price of each sat skyrockets to $1.00 tomorrow (not a prediction, nor financial advice), you essentially have no screw you money (Click the link for the rated-R version). $500 is a lot of money for some people, but 500 sats is unspendable in a self-sovereign way. Sure, you could buy a $400 computer, add more sats, and become sovereign some other time, but 500 sats NGMI.

Bitcoin Is Logos

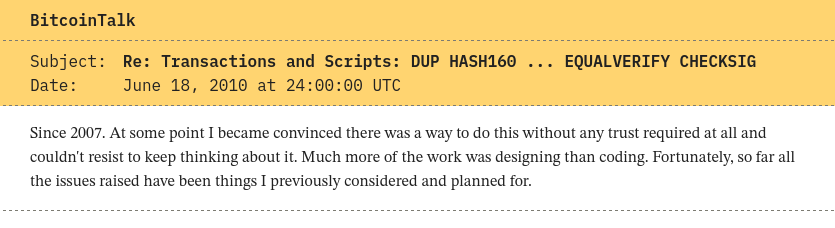

Bitcoin is math and math is pure logos. The person who discovered this mathematical technique has no ethos. They said they were a man, but it could have been a group of people. Nobody can call Satoshi a libtard or a nazi. We know they had an engineering mindset. They wrote code and obviously had some feelings (pathos).

We don't know. You may be able to use Newtonian physics to go to the moon, but the math breaks down at the quantum level. There is no unified theory of gravity. There is no self-sovereign way to hold 500 sats. Therefore, Cashu is your best option for less than 500 sats.

Unfortunately, your 500 sats could get hacked or rugged, but there is not much people can do about that given the onchain fees. You could send 10,000 sats onchain now and still spend if fees remain low. If they go up, you could be SOL, and I am definitely not talking about Solana. A good rule of thumb is to consolidate UTXOs of at least 1,000,000 sats. That will be difficult to do if we reach sat dollar parity, but it is possible for people in the Western world to do as of block height 900,000 or so.

The way I see it, if you're just playing with bitcoin for the first time, it's not a bad idea to use a wallet like Minibits. You can spread 1,000 sats on 5 different mints if you're really paranoid. Maybe one mint will rug you, but you'll still have 8,000 sats. Whatever you do, **mitigate your risk of loss by learning how to use the tools of freedom with small amounts first. Also keep in mind, just because you can do something doesn't mean you should do it. For example, you could memorize 12 words and have no trace of your bitcoin anywhere. Should you do this? As anyone who has watched a character bump his head on a soap opera knows, of course not! Start out slow. Start with The Cash App or Strike.

I know they do the KYC, KYC is an illicit activity, and trusted third parties are security holes. Strike allows us to do some interesting things, but the Cash App has Lindy and has been around for a long time. This is not to say you want to trust them forever, but while you're learning, sometimes it is better to trust someone if they are more trustworthy than you. Then, after you've studied the bitcoin protocol enough and understand it well enough to take self-custody, you should do so.

Bitcoin, done right, is self-sovereignty. You can earn payments right away. When you're ready:

-

Buy a bitcoin-only hardware wallet.

-

Make a wallet by writing down 99 dice rolls or 256 coin flips.

-

Run a node.

-

Make steel backups. I like Cold Steel because they are easy. You want to be able to erase even smaller wallets with a brick me PIN and retrieve it later, even if there is a fire.

-

Use MultiSig. Several companies can help and more are being built.

-

Use Timelocks.

-

Mine bitcoin. I'm not saying build a mining farm that the New York Times will write about. I picked up a BitAxe for 125,000 sats. It's like a lottery ticket. This is not a +EV bet. I don't expect to win, but I want more plebs to have these in case the suits take down the mining companies. Besides, I think an anonymous pleb winning 3.125 bitcoin is way more interesting than anything you'll see on CNBC, but that's my bias.

Hacking Bitcoin Payments With Nostr

I tried vibe coding a point of sale terminal, but I don't know how to run it. I only started doing this like a week ago. I still have much to learn. I was able to get claudr to build me an HTML point of sale terminal using duck.ai. It's not as sexy as a TailWinds CSS React Native app, but it can work.

In many ways, ZapThisBlog! is a payment terminal. I have links that allow people to send me sats on a Ghost Blog. We could do something similar to make a Nostr-based payment terminal, but why re-invent the wheel? If you are a business owner that wants to accept bitcoin payments, just do this. The fees are reasonable for all but the smallest transactions.

Real World Recurring Bitcoin Payments On Nostr

At Bitcoin 2025, I hung out with a guy from the Damus team. We wanted to see a speech about "bitcoin payments." It intrigued us because this is the stuff we're into, but the talk was not what we expected. It was some shiitake mushroom coin.🤮

I recognized someone from the next panel though, an author I once met at a local meetup. He happens to live somewhat nearby me according to the Orange Pill app. He was on the next panel. He also happened to mention that he just started a gym a few months ago. I hit him up after the speech.

"Dude! Where's your gym? My son wants to Jiu-Jitsu," I said more than that because I tend to blab, but you get the idea.

I plan on experimenting with recurring payments for Jiu-Jitsu classes. My son tried it out this week. He likes it so far. I plan to pay the monthly fee using ZapPlanner. Every 30 days I can automatically send the payment. There might be some time when the power goes out and the auto-pay doesn't work, but it's not a big deal. I can just send it manually in that case. This is a win-win-win situation.

-

My son learns Brazilian Jiu-Jitsu.

-

His Sensei stacks sats.

-

I get to test ZapPlanner in the real world scenario.

I don't want to sign up because I'm starting to have knee issues, but I think I'm fooling myself. He also said some people pay $20 per class once a week. I might try this, but I want to send 316 sats every minute for an hour class. This means the sensei gets paid 33 cents worth of sats per minute of class. I can do this with OakNode or ZapPlanner. Both tools now use Nostr Wallet Connect! To be honest, it's overkill. I don't think I'll actually make a habit of this, but it's pretty cool and I like playing with these bitcoin toys.

But wait...There's more. Say the Sensei stacks some of these sats for his grandkids. Those sats get taken off the market. The value of each of our stacks goes up. We have different amounts of sats, but bitcoin raises all tides. Bitcoin is capital in a world of communist central banks. Erik Cason, in Cryptosovereignty, calls bitcoin a commonwealth on the Internet. I like this definition. We are a community founded on the politics of public key cryptography first described by the Eric Hughes in 1993, not Tik-Tok politics. Is it banned? Is it not banned? I don't really understand how that works, but I know how proof-of-work works.

The Bitcoin Timeclock, often described as a truth machine, is for the common good. Bitcoin is for everybody. Few understand this. Bitcoin is a peer-to-peer electronic cash system that made a commonwealth on the Internet. Few understand this. Bitcoin is built with cryptography. Few understand cryptography, but bitcoin is for everybody who is capable of writing down 12 or 24 words to get started. How will you use bitcoin? for payments?

☮️

https://nostree.me/npub1marc26z8nh3xkj5rcx7ufkatvx6ueqhp5vfw9v5teq26z254renshtf3g0